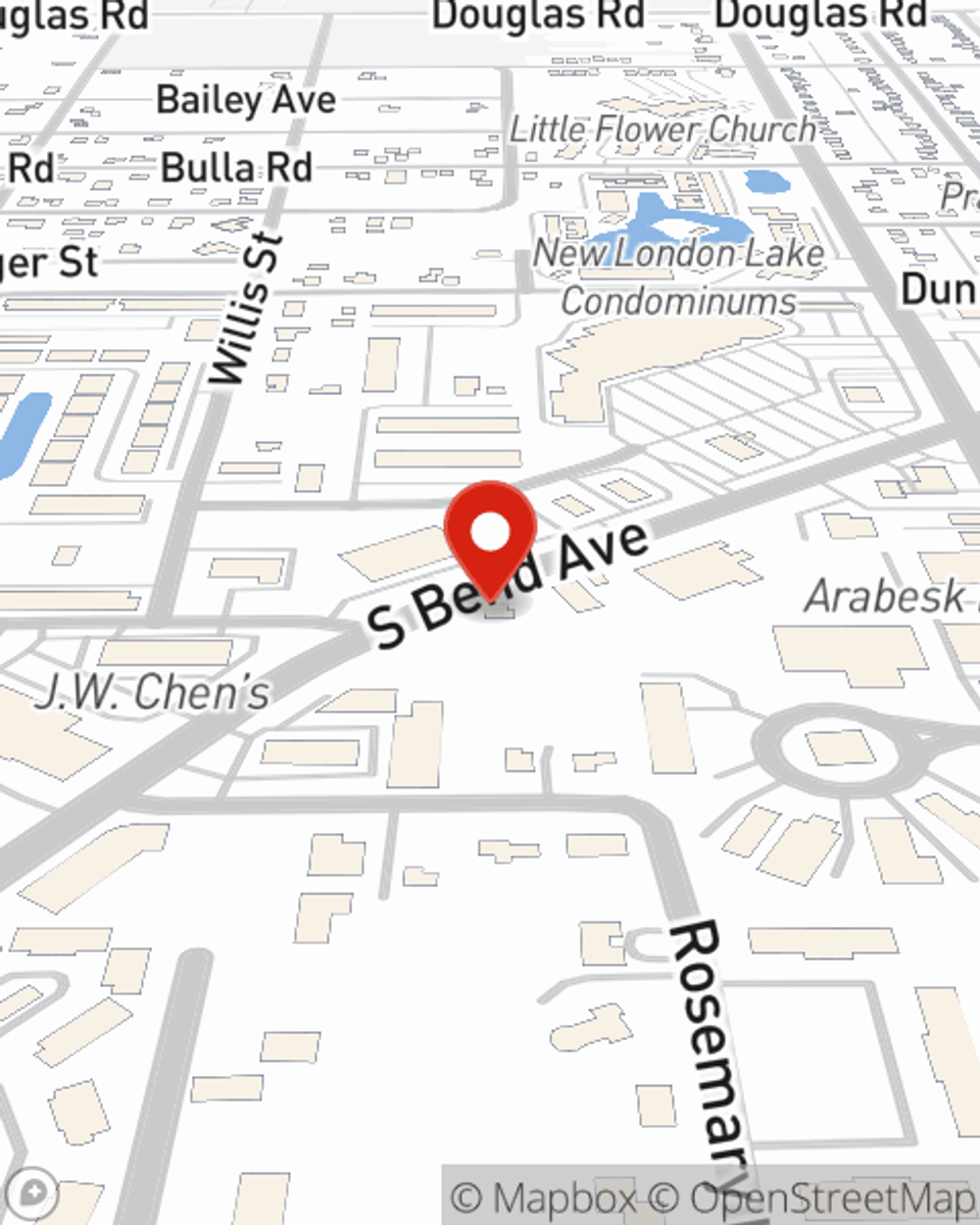

Business Insurance in and around South Bend

Looking for small business insurance coverage?

Insure your business, intentionally

This Coverage Is Worth It.

Running a small business comes with a unique set of highs and lows. You shouldn't have to work through those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, errors and omissions liability and business continuity plans, among others.

Looking for small business insurance coverage?

Insure your business, intentionally

Protect Your Future With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Rich Was for a policy that protects your business. Your coverage can include everything from business continuity plans or extra liability coverage to commercial auto insurance or group life insurance if there are 5 or more employees.

Reach out agent Rich Was to explore your small business coverage options today.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Rich Was

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.